Startup Business Loans

3 Hacks to Take Your Business from Dream to Reality

For a business startup nothing is more important than getting up and running. After all, what’s the benefit of a great idea if you don’t put it into practice? Many brilliant business ideas never see the light of day. They are born and extinguish themselves without ever existing in reality because the would-be entrepreneur lacks the funds to make them happen. It’s a sad truth… but one you can avoid with a little planning. This is the point of this whole article.

Table of contents:

The Beginning is Unique

The beginning stage of a business is totally different than anything that will follow. It’s like a human baby. That baby can grow up to be a great general that will command armies and score huge success on the battlefield, but in the beginning it’s just like any baby. It depends on others for food, protection and even changing its diapers. Not exactly the most glamorous job out there but it needs to be done so this baby can grow up to be the general he will one day be.

It’s the same for your business startup. It needs to be nurtured and taken care of so that it can become the huge financial success it will one day be.

As you start your business journey you’ll have to consider the options for financing your business “baby”. At this stage of the game your choices will probably be few and far between… unless you have a rich uncle who is willing to write you a fat check just because you ask him.

What To Do?

Assuming that you’re at the idea stage with very little to show for it, you might think of going to investors. But the data shows that it’s not the most viable option. There are many stories of entrepreneurs that show up to an investor with a plan drawn out on a bar napkin and somehow get the money.

In most cases those are just stories. Investors look for at least an MVP, which stands for minimum viable product, and some sort of traction such as some sales or preliminary sign-ups.

That leaves us just a few tangible options: go to your friends and family for money or take out a loan… or a combination of these.

Loans are probably the most used method to get your business idea from paper to real life. And this is where most entrepreneurs go wrong.

Busting Loan Myths

The common misconception is that getting a loan means applying to a financial institution and then waiting for a result. That’s why the majority of entrepreneurs fail and those new businesses never see the light of day.

Imagine you’re standing at the entrance of a vast, intricate maze. Your goal is to reach the treasure at the center. Now, you might think it’s as simple as walking straight ahead and hoping for the best. But anyone who’s ever faced a real maze knows that this approach will likely lead you to dead ends, confusing turns, and frustrating setbacks.

Understanding the loan process for a startup is similar to navigating this maze. On the surface, it might seem like you just apply and wait for the money. But in reality, it’s a complex journey with its own set of rules, twists, and turns.

So let’s fix this misconception: Getting a loan for a new business is a process that requires a deep dive into details, studying and formulating a strategy… and then having the guts to stick it through until you get a result. It involves multiple attempts, from multiple financial institutions that are timed just right to make it work. It requires you keep meticulous track of everything as you go through this process, because as they say “the devil is in the details”.

“

Getting a loan for a new business is a process that requires a deep dive into details, studying and formulating a strategy… and then having the guts to stick it through until you get a result.

1. Organize and Win… Hacking Lending

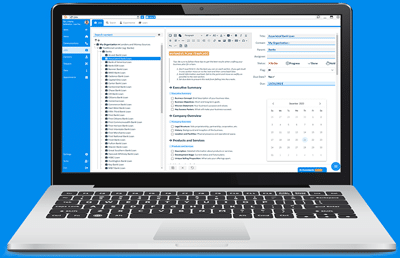

We just talked about the importance of understanding the loan process and approaching it in an organized methodical way. One of the easiest ways to loan hunt like a pro is with GoDataHub’s free Loan Finder tool. With over 4,600 banks and credit unions as well as alternative sources of financing, it’s the best way to get yourself setup for success. This way you’ll have more options and therefore more possibilities for that YES.

On top of that, the Loan Finder tool also comes with templates and documentation for business plans, pre-loan documentation process, loan stacking, funding campaigns and more.

Not only does it provide the resources you need to search for funding options that suit you best, but it helps plan you strategize and gives you hints and tips on how to avoid mistakes that can sink you. It has documentation, tutorials and guides on how to set yourself up right so you can have the best chances of approval.

You also get a robust system for keeping track of every step. As we noted before, to increase your chances of approval you must implement a broader approach that includes multiple applications that are timed just right. Because most entrepreneurs tend to get overwhelmed, they let things slip between the cracks which results in denial. Use the task system to make sure you get it done.

Additionally, because proper loan-hunting includes a lot of communication with financial institutions and bankers, you also get a full communication logging system to make sure that you keep your message clear and avoid problems such as saying something in one phone call and contradicting yourself in the next. You’ll always have a clear picture of what was said, to whom and on what day and time.

All this, and it’s absolutely free, which makes it a no-brainer.

As if that wasn’t enough, the Loan Finder tool also has appointment, reminder, and deadline settings to make sure you don’t miss that important cut-off date or that make-or-break phone call.

Everything is in one single package so instead of focusing on juggling information in different places you can concentrate on your strategy and get funded.

2. Break The Pie with Loan Stacking

Remember the last time you celebrated your birthday and shoved a full birthday cake into the mouth of your friend? No? Me neither. We usually cut the cake or pie into slices because giving the full cake to just one person is too much. Banks may feel the same way when they see the full sum you’re requesting.

So instead, what we can do is portion that request into multiple slices and get a lending institution to bite on each slice individually.

This is called “loan stacking” and it’s a way to pool money from multiple lenders. Many new business owners have found success with this technique.

The Good – You can probably get a larger total sum by loan stacking. The smaller the ask from each lender, the higher the chances they’ll approve your request. That means that you can hit a bunch of banks and end up with much more money in the end.

The Bad – Like anything else, there are some problems here. We’ll fully address loan stacking in another article. But in short, Loan Stacking is great but if not done carefully it can really create problems.

The Ugly – It’s not the easiest thing to pull off properly. So in order to do it you need to pay attention and be very methodical. A tool like GoDataHub’s Loan Pack is really helpful when it comes to making sure you’re doing loan stacking like a pro.

“

You can probably get a larger total sum by loan stacking.

3. Forget Banks… Explore Alternative Options

Did you ever think “Ehhh… banks schmanks… are there any Alternative Options”?

The answer is YES, there are. Some of them require completely different approaches. We have plenty of articles on alternative funding options and how to best approach them and you may want to read those for more details.

But first, let’s define “alternative”. In short, alternative loan options are options that do not involve traditional banks. These options can be a great source of capital… or at least provide a piece of the pie.

The advent of online lending has really opened up the market and made us have more choices. For example there’s FundingCircle who bills itself as the “leading global provider for small business loans”.

Eh, I don’t know about that but they’re definitely worth a shot as part of a comprehensive startup loan strategy. So is LendingClub.

A lot of online lenders will focus on personal loans, which in most cases you can use to starting your business. While the prospect of taking out a personal loan for a business may seem foreign to some newbies, the fact is that when you apply for a startup business loan it will still be tied to your personal finances.

“

These options can be a great source of capital… as part of a comprehensive startup loan strategy.

Get Started

Loan hunting can essentially determine the fate of your new business, especially at this early stage.

Once you understand its importance, you understand why loan hunting is something you must put 100% of your effort into. Approach it with the seriousness it deserves. Done right it almost always gets results.

Remember this: Amateurs apply for loans. Professionals loan-hunt.